The Evolution of Retail Strategies in Commercial Real Estate Investment

play 99 exch, lotus bhai, playexch: The Evolution of Retail Strategies in Commercial Real Estate Investment

Retail has always been a crucial sector in the commercial real estate investment industry. Over the years, retail strategies have evolved significantly to adapt to changing consumer behavior, technology advancements, and economic trends. In this article, we will discuss the evolution of retail strategies in commercial real estate investment and how investors can navigate these changes to maximize their returns.

The Rise of E-commerce

One of the most significant shifts in the retail sector in recent years has been the rise of e-commerce. With the convenience of online shopping and the ability to compare prices and products easily, consumers have shifted a significant portion of their retail spending online. This shift has had a profound impact on brick-and-mortar retail spaces, leading to closures of physical stores and malls.

As a result, commercial real estate investors have had to rethink their retail strategies to adapt to the rise of e-commerce. Many have focused on investing in mixed-use developments that combine retail spaces with residential or office spaces. This diversification helps offset the impact of declining retail sales and increases foot traffic to retail spaces.

Embracing Technology

Another key trend in the evolution of retail strategies is the embrace of technology. From online booking systems to digital payment options, technology has revolutionized the way retailers interact with customers and manage their operations. Commercial real estate investors have had to incorporate technology into their retail spaces to attract tenants and enhance the customer experience.

For example, some investors have invested in smart retail spaces that use sensors and data analytics to track customer behavior and preferences. This data can help retailers optimize their product offerings and marketing strategies, leading to increased sales and tenant retention. Additionally, technology can improve operational efficiency, reduce energy costs, and enhance security in retail spaces.

Creating Experiential Retail Spaces

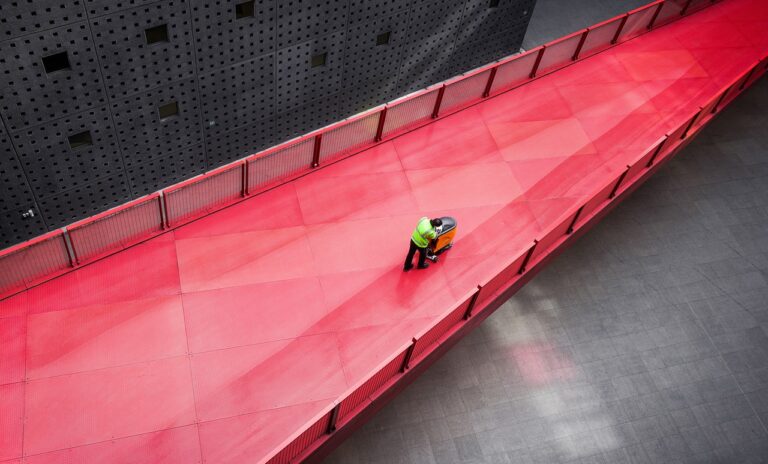

In response to the rise of e-commerce, many commercial real estate investors have focused on creating experiential retail spaces that offer unique and memorable experiences for customers. These spaces go beyond traditional shopping malls or street-front retail stores and incorporate elements such as entertainment, dining, and community events.

By creating experiential retail spaces, investors can attract customers who are looking for more than just a transactional shopping experience. These spaces often become destinations in their own right, drawing in customers and increasing foot traffic to retail tenants. Additionally, experiential retail spaces can command higher rents and have lower vacancy rates, making them attractive investments for commercial real estate investors.

Sustainability and Wellness

In recent years, there has been a growing emphasis on sustainability and wellness in retail spaces. Consumers are increasingly conscious of environmental issues and their own health and well-being, leading to a demand for retailers that prioritize these values. Commercial real estate investors have taken note of this trend and have begun incorporating sustainable and wellness-focused features into their retail spaces.

For example, investors may invest in green building certifications, such as LEED or WELL, to demonstrate their commitment to sustainability and wellness. Retail spaces with features such as energy-efficient lighting, indoor air quality monitoring, and green spaces can attract eco-conscious tenants and customers. Additionally, wellness-focused amenities such as fitness centers, healthy food options, and meditation spaces can differentiate retail spaces and appeal to health-conscious consumers.

Adapting to Changing Consumer Behavior

Ultimately, the evolution of retail strategies in commercial real estate investment is driven by changing consumer behavior. Investors must stay attuned to consumer trends and preferences to remain competitive in the retail sector. By embracing e-commerce, technology, experiential retail, sustainability, and wellness, investors can create retail spaces that meet the needs of today’s consumers and tenants.

FAQs

Q: How has the rise of e-commerce impacted brick-and-mortar retail spaces?

A: The rise of e-commerce has led to closures of physical stores and malls as consumers shift a significant portion of their retail spending online.

Q: What are some ways that commercial real estate investors have adapted to the rise of e-commerce?

A: Investors have focused on investing in mixed-use developments, embracing technology, creating experiential retail spaces, and incorporating sustainability and wellness features into their retail spaces.

Q: Why is it important for investors to stay attuned to changing consumer behavior in the retail sector?

A: Staying attuned to changing consumer behavior helps investors remain competitive in the retail sector and create retail spaces that meet the needs of today’s consumers and tenants.

In conclusion, the evolution of retail strategies in commercial real estate investment is an ongoing process that requires investors to be flexible, innovative, and customer-focused. By embracing e-commerce, technology, experiential retail, sustainability, and wellness, investors can create retail spaces that appeal to today’s consumers and drive returns on their investments.